Increased Profits = Increased Business Value

What is the Easiest Way to Increase Profits When Organic Growth Stalls?

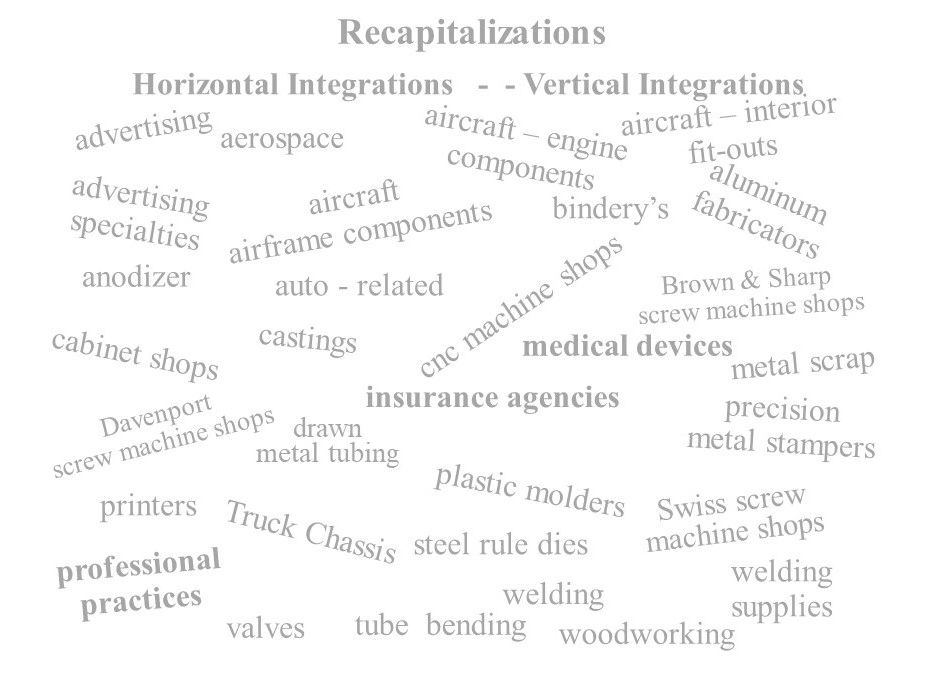

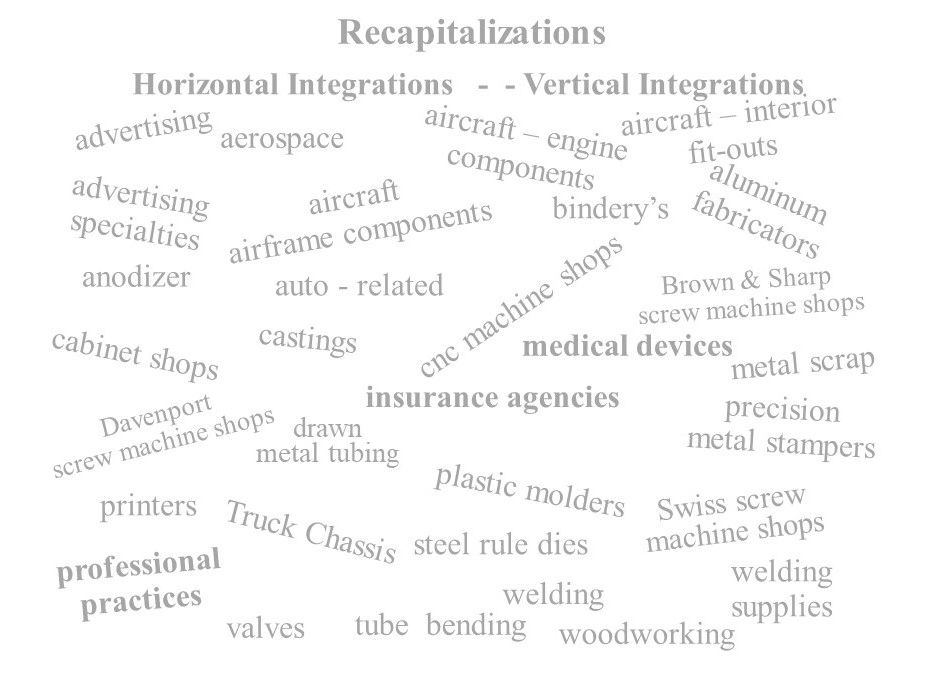

By Acquiring like-kind businesses/professional practices that are not presently for sale.

Business Acquisition Experience Matters

Since 1986, I have increased the Corporate Wealth of business owners. How? By doing exactly that....... acquiring like-kind businesses. Typically, my Clients made their final choice from a short list of 3 target finalists within 16 weeks of executing my Engagement Letter.

None of the businesses my Clients acquired were for sale. What is the significance of that? There was never a Sellers' Intermediary conducting an auction and running up the sale price by pitting the bid of one buyer against the bid of other prospective buyers

Who would you say received the better value proposition? My Clients', through me, the only Buyer on the scene? Or, those buyers bidding against other buyers?

My Clients, Executives/Owners', seriously intent on making acquisitions typically spend less money my way, including paying my fee, than they typically spent by following the conventional business acquisition methods.

Businesses, with revenues of $7 million or less typically sell for 4 X to 6 X EBITDA. After consolidating acquisitions within an industry, those Buyers found they, in-turn, increased the valuation of their business.

So? Why do bigger businesses sell for higher valuations? Critical mass! Larger business sell for valuations much greater than 4X to 6X EBITDA resulting in a sort of quadruple multiplier effect. A lot more profit times a higher valuation multiple.

As just one example - I acquired two welding supply businesses for a Client increasing their revenues from $20,000,000 to $30,000,000. The Client later sold to a major national gas supplier for $62,000,000 - - a valuation in excess of 2 times annual revenue.

The core component of my prior success for Clients was the businesses I acquired for them were not for sale. If you want to grow your business and its' value, quickly, that feature will prove to be your biggest benefit.

Few of my Clients actually wanted to acquire businesses to enhance their value for later sale. Some wanted to make financial room for other family members to come into their business. Others wanted to have to take a business trip to a sunny, warm. vacation-land area to manage a similar business.

Business buyers do not buy businesses. They acquire the benefit of what that specific acquisition does for them, either individually, or their business, strategically. Some Clients, outsourced from Executive positions with large corporate America simply now wanted to control their employment destiny.

The most frequent comment I hear from a business owner as I contacted them on behalf of my Clients' was “If the right Buyer came along it is time for me to listen” It is said that 45% of business owners are retirement age or older. That age dynamic translates to a huge opportunity. for my Clients'. Trillions of dollars in small business ownership needs to be transferred to someone.

Let's transfer some of that value to you and/or your business.

I have the know-how and demonstrated experience to present you as that “right buyer". I offer business Executives seriously looking to grow, two alternatives:

(1) I’ll make one or more acquisitions for you so as to materially increase your sales revenue, your desired profit before taxes and therefore the value of your business.. I call that Corporate Wealth Building. You get to write the script. If you can't find and hire an employee with specific skills? I add that to my work search statement. Need a specific fixed asset? I add that, too. It works!

(2) if you are seeking a very small Mom & Pop business, You can buy my Self-Study Seminar and, with some coaching from me, do it yourself.

Direct inquiries to charleskroha@gmail.com

Charles E. Kroha, dba

Synergistic Acquisitions

5753 Hwy 85 N, #2829

Crestview, FL 32536-9365

Copyright 2023

This website uses cookies.

We use cookies to analyze website traffic and optimize your website experience. By accepting our use of cookies, your data will be aggregated with all other user data.